JP MORGAN CEO DIMON: OIL AND GAS WILL BE NECESSARY FOR THE NEXT 50 YEARS.

Still billions of people who would like to have the energy usage and resultant standard of living the West has enjoyed, or anything remotely close to it. The fossil fuel demand may be there longer than Elon thinks. Intermittent, geothermal, and nuclear energy are gonna take some time.

Maybe even more than 50 years. For example, we still have 50+ year old planes using fossil fuels. Maybe in 50 years from now they will also be using 50 year old planes … that use fossil fuels.

Electric cars alone are not going to do it.

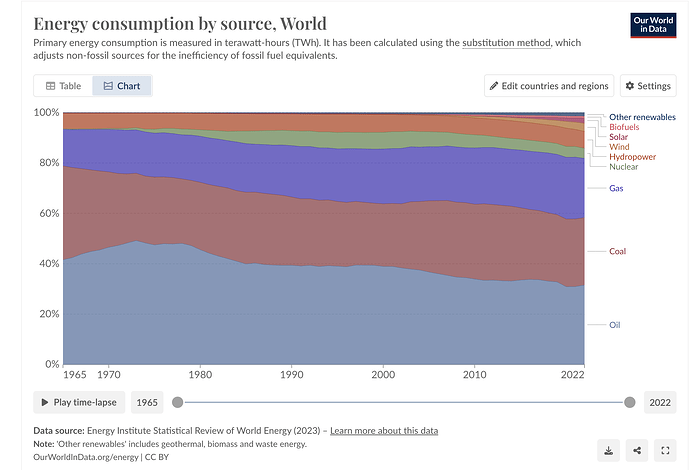

Renewables contributions is still small. It is clear that they still have not made meaningful contributions or displaced fossil fuels. The economics of fossil fuels is just compelling and billions have gone in infrastructure setup.

I feel worldwide focus on climate change is reaching a pivot and investments in renewables is increasing.

Would be interesting to see this chart go all the way back to when fossil fuels started becoming popular. It might be instructive to see how the curves of fossil fuel usage grew over time.

More Oxy purchases: 10.5 million shares, $588 million

Not sure what he is seeing. He has the conviction to pursue this.

It is troubling that WEB at 93 is choosing to allocate capital to Oil companies that are doing “drill baby drill”.

There are many ways to make money investing in renewable energy and help build sustainable energy.

Do we know it’s a WEB decision? Could it be one of the other guys?

What is troubling at 93 he is still in charge? or he is buying Oil stocks? He is not doing any drill baby drill… Whether WEB owns OXY or not is immaterial to OXY’s decision to drill an Oil well. IF WEB is not owning OXY, do you think OXY is not going to be Oil Company.

I understand we need to care about environment, invest in alternate technologies etc. But the simple reality is today we are dependent on Fossil fuels and until you have a reliable alternative it is going to be here. So we need to stop making these people as some Villians or bad actors. No, they are not. They are serving an important need to the society. If the entire world stops producing Oil and consuming Oil for a few weeks, can you imagine that world?

So don’t be troubled by WEB or his purchase of OXY.

Berkshire is 25% owner of OXY due to Buffet’s relentless buying.

Buffett is now part of “drill baby drill” operation in the Permian basin.

I understand that he has fiduciary responsibility to his shareholders.

I was hoping he would factor in the future of the next generation and allocate capital likewise.

This is absurd. Berkshire should ONLY invest in things they believe will provide profit and a gain in value sometime in the future. Subsidizing things that are good for the world is something that governments do. I guarantee that where there are profit motives, plenty of capital will be allocated to alternative energy, including capital from Berkshire.

Destroying the planet for short term profits does not serve anyone’s interest, especially of the next generation.

It is wise to err on the side of sustainable energy. Amazon, Apple, Google are all deploying billions towards this. Capitalism done right !

Beautiful ad below (5mins)

This is a ridiculous statement with respect to Berkshire. WEB has repeatedly stated over the decades that his favorite holding period is “forever”.

This is clearly not true. Those companies are deploying capital into alternative energy that ALREADY has financial benefits for their company. Berkshire owned companies similarly do so. But all these companies also use plenty of energy on their own, sometimes energy that could be considered “wasteful”, and derived from fossil fuels. Investing in companies that provide fossil fuels is not an evil thing in itself, because fossil fuels are still essential to the working of the world. But, again, you can be sure that when alternative energy shows profit (which will likely coincide with when it will take off rapidly), Berkshire will be sniffing out good opportunities in the field.

Saudi Arabia is a huge producer of fossil fuels, but also is a heavy investor in an EV auto company, is also investing a massive amount in “the city of the future” (including future energy sources, etc). And also it is a heavy investor in golf, a simple game, that could be considered entirely wasteful and environmentally harmful.

“Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.”

James W. Frick

I came back from my travels abroad. The surge in renewable energy is real. Electrification of transportation is real.

Solar on house tops and Windmills EVERYWHERE. Solar in particular seems to be taking off big time. Data analytics confirms this as well.

This no longer seems just a renewable story but a compelling financial / economic for households. The cost optimizations will continue as China is seriously ramping up manufacturing of Solar PV.

I finally got around to listen to the Oxy quarterly earnings call. I am intrigued as to why Buffett has conviction about this company. He has been relentlessly buying it.

A few observations

- DAC - Direct Air Capture (C02 capture) was the focus of the call. In fact it was 80% of the prepared remarks and Q&A discussion

- There are legislation mandates coming up later this year that are not possible without DAC

- OXY is in relationship with Blackrock re: capital infusion in this tech. Amazon and Oman are also partners/customers

- They think the world will need thousands of DAC stations

Vicki A. Hollub:

What’s been very helpful for us is that as we went through and interviewed

the various vendors selected those that we felt like were more visionary. We also found that these more visionary companies also were very

committed to making this work because what they realize and what’s important to them is to do something that benefits the world. And if you

look at the CO2 going into the atmosphere today, it’s about 35 gigatons and of that 35 gigatons going into the atmosphere, 8 comes from and

that’s 23% comes from transportation and that’s what Richard was getting at earlier.

It’s really hard to do anything to decarbonize transportation unless it’s a sustainable aviation fluids, SAF, like he mentioned, which is not completely

emission-free or using our carbon reduction credits. And when you look at 8 gigatons, that means thousands of these Direct Air Capture facilities

must be built and no matter what model you look at, that’s credible around the globe with respect to climate transition and climate change.

There’s no model that would show that you can cap global warming to 1.5 or 2 degrees without dealing with getting more CO2 out of the atmosphere,

both for transport and just because there’s too much in the atmosphere today. So that makes it a necessary technology and one that’s important,

as I said, for the world.

And it’s important to distinguish between the CO2 that goes into the atmosphere from power generation. Power generation can be addressed by

wind and solar to some degree and ultimately, fully if we can – if a battery or some sort of industrial battery can be designed and built to aid it. But

this Direct Air Capture is not a replacement for wind or solar. That’s for a totally different type of CO2 emission