I am pretty sure most of you have read peter lynch. There used to be a retail fund manager, who I think memorized Lynch. So can anyone answer why he bought high and sold low, and bonus marks for identifying the industry.

I read a couple of his books and was duly impressed but I never heard about this buy high, sell low P/E business. For a few years I hosted a retail board at TMF, retail being one of Lynch’s darlings because they deal in mundane stuff that we use and understand. Pantyhose was a recommendation his wife made which Peter made into a good investment.

Since I was tracking dozens of retail stocks I observed their P/E ratios. Growth had higher ratios than stasis until growth was overdone and the business had to restructure. Starbucks was a prime example, they had to bring back one of the founders to clean up the mess..

It was this board that taught me that the P/E ratio is widely misunderstood by market participants. Thinking that low P/E ratios are a good thing has an underlying assumption, that all businesses are the same and the lower P/E means you are getting a bargain. That is waaaay too superficial. Investing is about the future which is why growth is rewarded with higher P/E ratios.

Listen to The Music Man, “You got to know the territory!”

BTW, Ross Stores is still going strong. I used to shop there (1985-90). Got lots of nice Oxford button down shirts.

That’s not me, I never got such a deep tan sailing the seven seas.

ROST 40 years

Average CAGR 21.1%

Current CAGR 19.5%

Beats the pants off many darlings. Between Sep. 2015 and Dec. 2017 it gave me an IRR of 35.3%

Stupid me didn’t stick with it.

The Captain

Cyclical stocks, such as industrials, often follow that pattern – when they are depressed the Earnings number falls giving them a high PE ratio.

DB2

Yeap. I don’t think he explicitly articulated this strategy. However, in his Chrysler and some other cyclicals, he purchased when the earnings were at cyclical trough, and therefore PE was high. When the cycle was at peak, PE is generally tend to be low and before the cycle turns he exited the position.

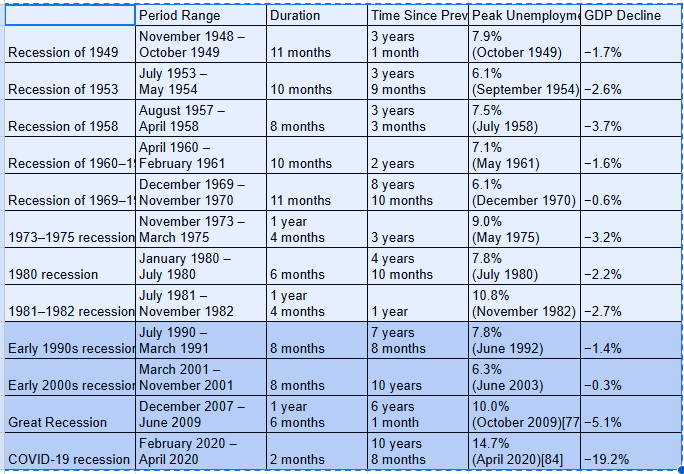

@WendyBG US used to have recession on an average every 4 years, so CAPE mattered, it adjusted cyclical earnings and PE and you had your cycle, often multiple cycles within 10 years. This is the first lighter blue part, between 1949 to 1982.

If you see post 1982, the time between recessions are longer. Also, the Index heavy weights are not cyclicals, and they have increased earnings, in all economic cycles. In other words, $MSFT of the world’s continued to increase income whereas $XOM had a much more pronounced up and down’s. This basically renders CAPE ratio not very useful in current environment.

Today, I think, the forward earnings estimate, and forward PE are more useful. See below, this is $NVDA revenue growth for 10 years… the 2022 market decline also coincides with the revenue growth halting… so forward revenue and earnings are better metrics, than looking cyclical past…

Yes, they are useful - but let’s be honest: they’re a guess. All the analysts in the world don’t know the future, and they’re often wrong - occasionally spectacularly so.

Even consensus estimates can be far off the mark, so the future they see may well not be the one that comes true.

The data contradicts any claim that analysts’ estimates are poor. Over 10 years, SP500 revenue surprise is 1.5%, and the standard deviation is 2.4%. So, it is not like the average is masking wild data fluctuations.

Most analysts have pretty good estimates on revenue, margin. Analysts have company provided guidance, industry surveys, during the quarter companies participate in many industry conference where they provide color, the analyst gets lot of updates, feedback throughout the quarter. So, their revenue estimates are pretty good.

Your post reminds me the erstwhile Berkshire crowd, specifically on CBI bankruptcy saga. The analysts were raising warning flags, I posted and highlighted possible bankruptcy… meanwhile someone was making 10 year estimate, with so much holes, utter lack of understanding of the business and absolutely unwilling to acknowledge the company had entered into a contract which is written so poorly, and it is going to bankrupt them… I kept raising questions… do you know what is the collective response of the board???

**

“Analysts know nothing, company management didn’t go stupid suddenly, we owned this stock for the last 3 months, how much stock these analysts own”, etc…

**

I am not trying to throw shade at them… rather typical investor overestimates their skills and underestimates markets/ analysts, etc.

So your retort is a single quote cherry picked from an internet board available to any moron with a keyboard? OK.

Here are a couple from the “analyst experts”:

There was not a single analyst with a “sell” ratings on Enron, right up until it collapsed.

2008 Jim Cramer tells viewers not to worry about Bear Stearns.

One analyst reiterated his “Sell Netflix, Buy Blockbuster” mantra 12 times because, um…

(Most analysts were bearish on Netflix for the first part of its public life)

Whitney Tilson went over the top on how bad the Google IPO would be and how the company wouldn’t be worth it.

Abby Joseph Cohen was bullish right up through the 2008 housing debacle; Goldman probably wasn’t too happy with her after that?

Not an analyst, but who can forget Steve Ballmer dismissing the iPhone as an overpriced toy?

And’ of course the greatest call ever: Irving Fisher in 1929 telling us the market had reach a new and permanent high plateau.

I started writing a detailed post about why your examples are cherry picking and going tangential… but you are going to come up even more extreme cases to defend your viewpoint.

When someone goes to 1929 to find a call made by an analyst to defend an argument… that clearly tells me instead of me focusing on the market, I am being busy getting into philosophical argument.

Cheers,

I think Goofy’s examples are right on target. Best of luck.

Peter Lynch’s Magellan fund was clearly a growth fund. Low PE implies investors expect earnings to fall. That is for value investors. Growth stock investors should tolerate higher PE. But spotting when stocks are over valued—PE absent or too high is also important.

Says the guy who picked one post from a public message board, while focusing on the last example (thrown in for humor) while ignoring the 7 others offered and the hundreds of others available with just a few keywords in the search bar.

Did you watch “The Big Short”? (Or read it?) Remember the scene of all those experts walking out of Lehman with their boxes of office belongings? Remember? That was 2008, consensus of analysts! “Not a problem here.”

Ho ho ho.

No idea what you are talking about but lots of crappy stocks have low P/E ratios.

So I’m guessing the retail fund manager thought that low P/E stock was crappy and sold it.

How far off am I?

Peter Lynch didn’t base investing on P/E numbers but on the products business made and sold.

The Captain

Not true. Lynch liked ‘growth at reasonable price’ for that he modified PE with PEG, PE ratio divided by growth rate. Yes, he talked about investing on knowing things, these wildly successful investors, WEB included, are actually lot more complex, nuanced investors. Often, they simplify their concepts for ordinary investors, but that doesn’t mean their process is that simple.

Very. The point is, PE on its own is useless. In a cyclical industry high PE often means, the cycle is at the bottom and a low PE means it is at peak.

Also, Lynch used PEG, so what looks like high PE, may be very reasonable PEG, and a low PE for a low/ no growth company would be very high.

The entire point of starting this thread is, one metric by itself is not very useful. Often you need to combine this with others to get a much better picture.

Gotcha. I was mistakenly assuming the fund manager thought the low PE stock was crappy and that’s why he sold it.

But you’re saying the low PE stock was a great business and that’s why he sold it.

You got it smarty… go buy 100x PE, because they are great business…

Back at ya. You said I was wrong because the fund manager sold low P/E businesses because they were crappy businesses.

Which was the same thing you were saying. But I’m clearly wrong even though I was agreeing with you.

Please re-read. If your entire point is just being argumentative.. Have fun, if not, you have reading comprehension problem.

I apologize for agreeing with you. My mistake.