Ben’s Portfolio update end of May 2024

Returns and portfolio holdings:

Portfolio Notes 2020 63.6% Since May 12, 2020, when I started this portfolio with over 40 companies, mostly holding large cap tech & FAANG, but also some high-growth SaaS. 2021 13.1% Discovered Saul’s board in February 2021 and started concentrating to 16 companies through December 2021. 2022 -60.7% Concentrated a bit more through July 2022 from which point I started posting my monthly updates on Saul’s board, holding about 12 or fewer positions. 2023 77.8% 2024 YTD Month Jan 5.9% 5.9% Feb 17.5% 10.9% Mar 13.6% -3.3% Apr 6.4% -6.4% May 6.8% 0.4%

These are my current positions:

May 2024 Apr 2024 First buy* Nvidia 22.5% 18.3% 5/13/2020 Crowdstrike 18.0% 17.3% 5/13/2020 Datadog 13.4% 15.0% 5/13/2020 Snowflake 11.0% 12.9% 2/8/2021 Cloudflare 11.0% 14.6% 11/2/2020 Zscaler 9.6% 10.0% 3/4/2021 Monday 5.9% 5.1% 9/13/2021 Samsara 3.1% 3.3% 1/8/2024 Axon 2.9% 1.2% 4/2/2024 TradeDesk 1.8% 1.7% 5/13/2020 Enphase 0.8% 0.7% 5/15/2020

*held through today

Company comments:

Monday:

Key insights:

- Price increase is turning out to have better impact than even management expected, with gross retention reaching an all-time high in Q1.

- While a price increase has a one-time impact on net new revenue, it just started in February and will roll through gradually as customers renew their contracts, so revenue tailwind will be prolonged through H1 of the next FY.

- Future, additional price increases possible as they keep adding value to the platform.

- Revenue guides suggest that management expects FY24 revenue growth not only being driven by the price increase, but also by underlying business performance improvements.

- Land and expand is doing well, with NRRs stabilizing and expected to tick up towards the end of the FY and customer growth continued strong, even slightly accelerating QoQ for all customers.

- New CRM and Dev products doing extremely well and already contribute significantly to both fraction of customers using these products and revenue (as they are priced similarly to Monday’s core product, Work Management).

- Expected hit on profitability due to renewed focus on revenue growth combined with typically higher Q1 expenses did not materialize. Instead margins dropped only slightly from Q4, resulting in a 10+ percent margin expansion YoY.

Monday reported Fiscal Q1 2024 on 05/15/24 before the market opened. In my mind this was a pretty flawless report, especially on the back of what I thought a much weaker Q4. I think three things possibly drove the better-than-I-had-expected Q1 results. First, their price increase already started paying off and it looks like it is paying off better than even management expected. Second, very uncharacteristically for Q4, they had increased their operating expenses from 76.5% of revenue in Q3 to 79.3% in Q4 (the first and only percentage increase from Q3 to Q4 I have on record). Management did say in their Q4 report that this was deliberate, prioritizing future revenue growth over profits. Could this already have impacted this Q1’s revenue numbers? And third, after a weaker Q4, a regression to the mean could also have resulted in relatively better Q1 numbers. One thing I found particularly interesting is that their price increases started just in February, so well into Q1 and only applied to customers with monthly plans and those who happened to renew their annual contracts in February/March. What that tells me is that we’ll likely see continuing tailwinds, positively affecting both top and bottom line as other customers start renewing their contracts later this year. Indeed, Monday updated their FY24 expectations for the price increase revenue impact from previously $15-$20M to now $25M. They also pointed out that the price increase, while value driven, was better received than they had anticipated as gross retention “reached an all-time high in Q1, continuing its upward momentum over the past year.” So where did this leave us after Q1?

Q1 Revenue was $216.9M (7.1% QoQ, 33.7% YoY), above my expected $215M (6.2% QoQ, 32.5% YoY). This is significant because they finally (and unexpectedly) broke out of their historical $13M sequential net new revenue range, delivering $14.3M net new revenue. And their Q2 guide suggests that they will be able to stay significantly above $13M going forward. For example after beating Q1 guide by 3.8%, a 3.0% beat of their new Q2 guide would result in close to $18M net new revenue (just for reference, they beat their last Q3 guide by 2.8%, so I wouldn’t get carried away expecting another beat of 3.8% or more for their upcoming Q2). One thing that’s worth pointing out here is that a price increase creates essentially a one-time tailwind for revenue growth. And even though we can expect that tailwind to slowly materialize throughout FY24 in into H1 of the next FY, as customers one-by-one renew their contracts with higher prices, the increase in quarterly net revenue adds we’ll see in FY24 will be driven at least partly by this price increase. So will Monday again be stuck in a higher net new revenue add range once everyone has renewed their contracts? Not if other revenue growth drivers play a role or if Monday makes another price increase in a year or so, but this is something to keep in mind. It is also interesting that they increased their top-line FY guide by $16M, which is quite significantly above the $5 to $10M they added to their price increase impact estimate. This shows that they expect continued positive momentum in revenue growth independently of the price increase.

How did the land-and-expand motion continue this Q? On the “expand”-side, NRRs really seem to be stabilizing; unchanged from last Q for all customers at 110%, slightly down to 114% from 115% for 10+ and $50k+ customers and slightly down to 113% from 114% for $100k+ customers. “We currently anticipate reported NDR to remain stable throughout fiscal year '24, with an expected small improvement by the end of the year. As a reminder, our net dollar retention is a trailing 4 quarter weighted average calculation.” - OK with me.

On the “land”-side lots of good things happened in Q1. QoQ growth of customers with 10+ users stopped decelerating for the first time after a year of deceleration, and ticked up slightly to 3.4%, from 3.2% in Q4. Considering that Q1 has historically been a somewhat seasonally slower quarter for customer growth, I am also happy with the $50k+ and $100k+ net adds, growing 48% YoY and 55% YoY, respectively. The real highlight however was their account additions to their new Dev and CRM products which are now generally available. QoQ account growth was 44.3% and 27.5% (up from 20.8% and 39% in Q4), respectively! This corresponds to YoY growth of 307% and 212%. It is really amazing to see such growth and even acceleration from what I wouldn’t necessarily call a small base - after adding 642 dev accounts and 3658 CRM accounts, the totals stand at 2090 and 16976. How meaningful is that you might ask? And what can we expect in terms of these two products driving future revenue? I think two things are important to consider here: First, is the number of customers using these new products already material? And second, how are those two new products priced in comparison to their work management product? To the first question, they had about 225000 total customers in Q4 and 55000 customers with 10+ users in Q1. With over 19000 combined customers using Dev and CRM already I’d say this is already very material, even though these two products became generally available just during this Q1. And with regard to pricing (https://monday.com/pricing), it looks like these two new products are priced pretty much equally as their work management product, with the CRM slightly higher than the other two. So overall, it is really great to see the momentum and even re-acceleration in CRM and Dev, when considering those two products are already contributing significantly to the pie both in terms of customer base and revenue.

Last but not least, I actually had expected a further dent on the profitability front for Q1. First because in Q4 they had said they want to prioritize revenue growth over profit growth and second because the first half of the fiscal year is where they have historically spent most on hiring and other things that seasonally drag down the bottom line. But not so this Q1: operating (9.9%) and net (14.6%) margins barely took a dent and are down only slightly from Q4 (while they grew headcount by about 7.2% QoQ), but have expanded by 10% from a year ago. And FCF margin reached a record 41%, growing 132% YoY to $90M, from $37M. Those are very strong numbers especially when combined with the strong revenue growth. So they were able to deliver strong revenue growth while, unlike the previous Q1s, not increasing their operating expense margin, which drove the strong bottom-line results. So well done, Monday!

Axon:

Key insights:

- Strong revenue (34% YoY) and ARR (50% YoY) growth.

- Bookings typically weak in Q1 due to budgets mostly closing in Q4, resulting in sequential decline of RPO, but strongest pipeline ever and FY guidance raise are promising.

- Gross margin dropped sequentially due to SBC, but up on an adjusted basis. SBC to stay at or below 3% annual dilution for FY25 and beyond.

- NRR stable at 122% and profitability continues to improve on EBITDA basis.

- Exciting new products and planned acquisition of Dedrone enhance a narrative for continued strong future revenue growth, beyond FY24.

Axon reported Fiscal Q1 2024 on 05/06/24. I thought they had a great quarter. Revenue came in way above my expectation at $461M (6.6% QoQ, 34.3% YoY) versus my expected $441M (2.1% QoQ, 28.6% YoY). ARR (which they restated “in order to comprehensively cover recurring warranty revenue”) grew 50% YoY and 12.7% QoQ. Historically, Q1 has been a seasonally slow quarter for both sequential ARR and sequential revenue growth. So it is really great that they managed to accelerate QoQ growth from 4.5% in Q4 to 6.6% in Q1 for revenue and 12.3% to 12.7% in ARR. So while net new ARR dropped in three out of four last years going from Q4 to Q1, it actually increased this Q1 to a record $93M, up from $80M in Q4. As a result of this, Q1 ARR divided by annualized Q1 revenue jumped to 44.8%, up from 42.3% in Q4 and 39.4% in Q3, demonstrating great forward momentum for future revenue growth.

They also said that bookings is typically weak in Q1 because police departments and agencies often close their budgets in Q4, which led to a sequential drop in RPO (future contracted revenue). I think part of the drop was also the RPO outperformance of Q4, so even with this Q1 sequential drop they grew RPO 47% YoY. On the other hand, they emphasized that they have a strong pipeline going into FY24, saying they are “happy to report that our pipeline is the strongest and healthiest it has ever been across all customer segments.” With the momentum from this and their ARR growth mentioned above they were confident enough to significantly raise their FY guide by 2.6% (So far, I don’t see many other companies raising their FY guides by that much this Q1.)

Gross margin took a hit this quarter due to stock based compensation expense, dropping to 56.4% from 61.1% in Q4. They said though that adjusted gross margin was 63.2%, up from 61.5% in Q4 and “we’ve committed to keeping our stock-based compensation at or below an average annual dilution of 3% for 2025 and beyond and this is in keeping with that commitment.”

In terms of expanding with existing customers, their NRR stayed constant at a strong 122%. On the bottom line, they delivered an adjusted EBITDA margin of 23.6%, the strongest it has been in 3 years. They also raised their adjusted EBITDA guide by 3.5% to $445M and assuming a similar beat as last year, I would expect them to continue to expand their FY24 adjusted EBITDA margin over what they delivered in FY23.

Accompanied by the strong growth in revenue, ARR and pipeline we saw in Q1, I really like the narrative component for this company. I think they have made some really smart new product developments and acquisitions that set them up for future growth beyond FY24. I am especially excited about their new Draft One product and their planned acquisition of Dedrone. Acquiring Dedrone would be a very smart move in my mind.

Dedrone provides advanced technology to detect, monitor and jam communications of drones in designated airspaces. I think this technology could be game changing in addressing the threat of future terrorist attacks with drones, where “The ability of a small group or individual to conduct multiple simultaneous attacks, at a relatively low cost and with significant standoff distance, will lead to the use of drones as a primary tactic of future terrorist attacks. The advantage is with the attacker; expensive counter systems for drones can be defeated with the addition or removal of specific onboard systems or a change in modality. Terrorists have already begun to experiment with the use of drones in their attacks—it would only take one high-profile attack for all terrorist groups to realize and exploit this technology.” Source: https://www.ausa.org/sites/default/files/publications/LWP-137-The-Role-of-Drones-in-Future-Terrorist-Attacks_0.pdf. Aside from defending against drones, with Dedrone’s technology, Axon could also potentially provide drone as first responder (DRF) services without the drone pilot or a human observer having to maintain a visual line-of-sight according to FAA regulations (keyword BVLOS waiver). This would make DRF not only practical, but could lead to quick and wide adoption throughout the US.

One of their newest products, Draft one, which uses AI to help generate police reports based on body cam audio and video, can create a strong bottom-up sales motion where police officers could push their departments to adopt this as it can make their lives so much easier and create more accurate and comprehensive reports at the same time. “Our studies have found that officers in the US spend about 40% of their time or 15 hours per week on what is essentially data entry, writing reports.” Draft One and Dedrone are of course just two examples that feed an exciting narrative around Axon. I recommend to watch the Q1 introductory video by Axon to get a good flavor of all the things they are working on, from minute 1:00 to minute 6:40, here: AXON Q1 2024 EARNINGS CALL

Datadog:

Key insights:

- large customer numbers up again by 150, up from 60 adds last Q. That was a big question mark ahead of earnings.

- Q1 revenue as expected and usage growth accelerated among large customers.

- Q2 guide and FY guide point towards revenue growth durability throughout FY24.

- Quarterly sequential revenue add on healthy trend.

- More revenue growth acceleration possible when AI cloud workloads shift more from model creation to inference where Datadog provides new observability tools.

- cRPO growth accelerated from 27.5% YoY a year ago to over 40% in the last two quarters. Correlation with revenue growth suggests potential for future revenue growth YoY acceleration or at least durability.

- Q1 RPO growth (and billings) was down sequentially most likely due to “more pronounced seasonality”.

- NRR stabilized and multi-product adoption trend continues.

- Operating and Net margins have expanded over 10% in a year, FCF margin expanded over 5% YoY.

Datadog reported Fiscal Q1 2024 on 05/07/24 before the market opened. Overall, I was pleased with this report. There was one thing I was worried about most before they reported and that was large customer growth numbers. My biggest fear was that raw adds would continue to deteriorate. If everything would have been as they reported, but large customer adds would have been less than last Q’s 60, I would have likely trimmed my position. And while I saw that as a possible outcome ahead of earnings, I did breathe a big sigh of relief when I saw the customer growth numbers. They added 700 total customers (up from 500 last Q), but more importantly, they added 150 customers that contribute more than $100k ARR. That is more than they added in any quarter of FY23 (130 → 80 → 140 → 60 → 1Q24: 150). The large customer adds are more important than total costumer adds (FY23 adds of 900 (organic) → 600 → 700 → 500 → 1Q24: 700) for two reasons. First, large customers make up 87% of Datadog’s ARR and second, Datadog’s management has been saying that they are more focussing on large customers. It seems that focus is showing clear signs of improvement!

Revenue came in pretty much as expected at $611M (3.7% QoQ, 26.9% YoY) versus my expectation of $613M (4% QoQ, 27.3% YoY). Q2 guidance was for $622 which I now interpret as $647 (5.8% QoQ, 26.9% YoY), a 4% beat, slightly up from last Q’s 3.8% beat. They also raised their full-year guide by 1.4% to $2.61b. With two more possible raises, my expectation for FY24 would be that they grow revenue to $2.7b, which would be a very nice continuation of their long-term trend in raw sequential revenue adds (my projection is that they’ll add $35M in Q2, $48M in Q3 and $53M in Q4):

Closely related to revenue growth, usage growth trends have also been positive as Datadog seems to have overcome the optimization headwinds: “As an illustration, the optimizing cohort we identified several quarters ago did grow sequentially again this quarter (…) and we saw usage growth accelerate across our larger customers, those with $100,000 of annual spend or higher. And we saw particularly strong usage growth with our largest customers who spend multiple millions of dollars with us annually.” And looking forward, “the April trends continue to exhibit higher sequential growth rates than the year-ago quarter.”

Ahead of earnings, someone on the board had pointed out the correlation of Datadog’s revenue growth to that of the hyperscalers, to which they had to say: “I will say also on AI adoption that some of the revenue jumps you might see from the cloud providers might relate to supply of GPUs coming online and a lot of training clusters being provisioned. And those typically won’t generate a lot of new usage for us . We tend to be more correlative with the live applications, production applications and inference workloads that tend to follow after that , and that are more tied to all of these applications going into production.” Especially with regard to inference workloads I found this statement interesting as it suggests a possible new, future revenue stream: “we have products for monitoring, not just the infrastructure, but what the LLMs are doing. Those products are still not in GA [General Availability], so we’re working with a smaller number of design partners for that.”

Two more thoughts on possible future revenue trends:

First, I couldn’t help but notice that cRPO YoY growth accelerated significantly from 1Q23 to 1Q24: 27.5% → 30% → 30% → 45% → 42.5%. While there is a clear correlation of cRPO YoY growth with revenue YoY growth one to two quarters later, it is not strong enough to make a good YoY revenue growth prediction. BUT factoring in a lag of a few quarters, it is quite interesting to see the correlation: For example cRPO YoY growth peaked in 3Q21 at 100% and YoY revenue growth peaked one to two quarters later at 83%. Then cRPO bottomed in 1Q23 at about 27.5% and YoY revenue growth bottomed again one to two quarters later at 25.4%. With cRPO YoY growth now above 40% in the last two quarters, will we see YoY revenue growth acceleration within the next one or two quarters? I wouldn’t bet on it, but it is an interesting datapoint nonetheless! (That is to say, I’d be happy if they can just continue to grow at about 27% YoY for the rest of the FY.)

Second, while I wanted to see a continuation of the mind-blowing RPO trend of the last couple quarters, where RPO grew QoQ 7.5% → 9.6% → 16% → 26.9%, it actually dropped by 6% QoQ in Q1, “as we saw fewer multiyear deals relative to last quarter”. Closely related, billings also dropped sequentially by 14.5%, in comparison to a 4.7% sequential drop in previous year’s Q1. So there is clearly a seasonal aspect and management essentially acknowledged that it was a bit more pronounced this year: “So yes, I think that we did see a decel. We had a very strong Q4 in terms of commitments to us, which manifests itself in billings . We talked about the larger customers committing to multiyear deals and committing to us. We do have a sequential factor, not in our revenues, which are based on usage as must, but basically in our billings and operations like that, usually in Q1 as clients sort of commit. So in some ways, we don’t have the seasonality to speak of in the revenues, but like we talked about in billings and RPO, we do have variations in billings. We’re not reading that much into it . In that – overall weighted, it’s going to vary, and we point everyone back towards ARR and revenues, but acknowledge that, that seasonality may have been a little more pronounced in this cycle than in the previous one .” Lastly, it is worth pointing out that YoY RPO growth was still up 52%, way ahead of revenue growth, pointing to a healthy future revenue pipeline.

Coming to the topic of NRR and expansion with existing customers, NRR stayed around 115% in Q1. So it didn’t drop further, but I’d like for it to start growing again going forward. What is maybe more telling is their continued progress with multi-product adoption. While the number of 2+ product customers has converged at around 82% and the number of 4+ product customers stayed at 47% this quarter, both cohorts of customers using 6+ and 8+ products moved to 23% and 10%, up from 22% and 9%, respectively. And their continued creation and release of new products gives confidence that these multi-product adoption trends will continue.

Finally, coming to profitability, both operating and net income margins were similar to Q4 and up significantly from Q1 last year (OM 17.9% → 26.9%, NM 20.4% → 32.1%). Free cash flow margin significantly exceeded my expectations and landed at 30.6%, up from 24.2% last Q1.

Cloudflare:

Key insights:

- Q1 was overall slightly softer quarter than I had expected, but no red flags.

- Q1 revenue and Q2 guide YoY growth indicate growth durability at around 30%.

- FY guide implies back-half deceleration, but pipeline, sales capacity and productivity are improving, implying acceleration → guide likely conservative due to “macro uncertainty”.

- AI tailwinds currently not monetized, instead current focus is on driving adoption. I think some investors expected more and faster - the hype cycle’s trough of disillusionment?

- NRR fully stabilized and customer growth OK, but going forward I’d like to see their land-and-expand engine pick up speed again.

- RPO has been growing significantly faster than revenue growth demonstrating healthy pipeline. cRPO growth has been more in-line with revenue growth, so RPO combined with cRPO indicates customers’ contract durations are increasing and revenue growth should stay durable this FY.

- Profitability margins trending and expanding well.

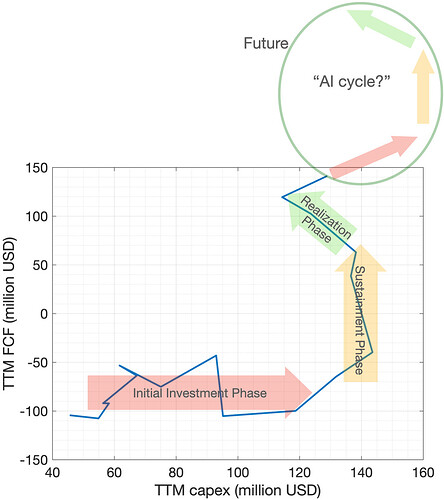

- TTM FCF as a function of TTM network Capex has been skyrocketing, not only demonstrating Cloudflare’s excellent and unique business model; namely generating revenue and FCF not on the back of the hyperscalers - and paying them for it indefinitely - but their own one-of-a-kind worldwide distributed edge network. Indeed, they have proven that they can scale free cash flow with incredible efficiency, essentially printing money (replotted below, fixing a mistake in the numbers when I originally plotted this):

- Detailed thoughts on Cloudflare’s Q1 earnings here: Cloudflare’s fascinating Q1 2024 earnings, and here: Cloudflare’s fascinating Q1 2024 earnings - #20 by SlowAndFast

Snowflake:

Key insights:

- Snowflake seems to have arrived at a point where revenue growth will be durable at or slightly above 30% YoY, with the potential of re-acceleration from a strong portfolio of new AI products becoming generally available this year.

- Land and expand support this where NRR seems to settle somewhere around 125% (extrapolating the smaller getting deltas QoQ) and customer growth’s 16.5% YoY run-rate.

- RPO growth has accelerated from 23% to 46% YoY in just three quarters showing strong commitments and cRPO has accelerated close to where revenue growth currently is, indicating growth durability in the next 12 months.

- Current headwinds of new tiered pricing and iceberg migrations are temporary and will turn into tailwinds over the longer term.

- Data sharing metrics were very strong this quarter, where Market place listings grew 6.2% QoQ, up from 3.6% in Q4 and >1 stable edge customers grew 23% QoQ, up from 2.6% QoQ in Q4 adding a record new 590 customers to this cohort (up from 65 in Q4).

- Profitability margins took a hit this quarter and will see continued headwinds in FY25 because Snowflake is investing into the AI opportunity in front of them (i.e. buying ~ $50M worth of GPUs).

Snowflake reported Fiscal Q1 2025 on 05/22/24. Product revenue was significantly above my expectation, growing to $790M (7.0% QoQ, 33.8% YoY), versus my expected $775M (5.0% QoQ, 31.3% YoY). But accounting for the extra day in the quarter due to the leap year, product revenue grew approx. 32% YoY, which brings it back closer to what I had expected. Still, while I hadn’t factored in the extra day when I made up my expectations, Snowflake’s management surely did when they gave their Q1 guide. And they beat it by a lot! 5.6% beat is way above their preceding 6-quarter average of 3.4%. In a way that confirms what many thought when they gave Q1 and FY25 guidance in Q4: That they guided extra low to set up the new CEO for success and make it easier for him to focus on execution and improvements rather than trying to beat Wall Street’s short-sighted expectations. “[CEO:] We have more to gain as we standardize our consumption mindset and effectively execute. We expect that this efficiency will contribute to further revenue growth.” A great example of this is their Arctic LLM: “In the quarter, we also announced Arctic, our own language model. Arctic outperformed leading open models such as LLaMA-2-70B and Mixtral 8x7B in various benchmarks. We developed Arctic in less than three months at one-eighth the training cost of peer models.” I think this is a good setup going forward and considering that Q2 has historically been stronger than Q1 in terms of quarterly net new revenue and factoring out the extra day in Q1, my conservative assumption would be that they’ll again add around $50M net new revenue in Q2, just like this Q1 and just like last Q2. With QoQ growth being a somewhat tough comp due to the extra day in Q1, Q2 growth would then end up being 6.4% QoQ and 31% YoY. It is also a good sign that they raised their FY guide by 1.5% to $3.3b. This gives me confidence that they’ll keep raising it, especially since “FY '25 guidance does not include revenue from newer features such as Cortex until we see material consumption”. Making some, what I think are reasonable growth assumptions, for the rest of the FY, I expect them to end the fiscal year with about 31.5% more revenue than in FY24.

Secondary metrics also give a good indication that they’ll stay at or above 30% YoY growth for FY25:

NRR was 128%. Still dropping, but the deltas become smaller and smaller: In the last four quarters NRR dropped by 9% → 7% → 4% → 3%. So if it can settle somewhere around 125% that would still be amazing, especially when combined with customer growth of around 15% YoY (their current run rate is 16.5%). All customers grew by 3.9% QoQ and they added 367 net new customers, which is actually up from 343 in Q1 a year ago. Customer adds are surprisingly seasonal, with Q4 always being the strongest quarter. Given that, I was happy to see them add approximately the same number of large and G2000 customers as they did in Q4. With that I think the land-and-expand is doing very well and shows the potential for future revenue growth durability, if not re-acceleration.

What also points to future revenue growth durability is cRPO, which grew 30.9% YoY. This metric has actually accelerated in the last three quarters: 27.7% → 28.5% → 30.9%. And total RPO grew even stronger and accelerated even more: 23.2% → 41.4% → 46.3%. This demonstrates that customers are willing to make longer contracts, which builds a strong pipeline for revenue. And while cRPO factors in management’s assumptions about consumption in the next 12 months, consumption could actually accelerate, as Snowflake releases (and already released) a whole slew of new products for general availability. “Earlier this month, we announced that Cortex, our AI layer, is generally available. Iceberg, Snowpark Container Services, and Hybrid Tables (Unistore) [and Streamlit] will all be generally available later this year.”

While optimization headwinds are abating (“Seven of our top 10 customers grew quarter over quarter.”), Snowflake currently faces two revenue headwinds: First, their roll-out of tiered storage pricing “that actually in the quarter impacted us somewhere between $6 million and $8 million”. Second, Iceberg currently creates a revenue headwind as some customers move data from Snowflake to Iceberg.

On tiered storage pricing headwinds:

“We did roll out to all of our customers, and we started, by the way, doing it at the end of last year, whereby depending on the amount of commitment you’re making on an annual basis, you get tiered storage pricing. So, in essence, you get your storage discounted from the list price of $23 per terabyte. We started rolling that out and that actually in the quarter impacted us somewhere between $6 million and $8 million. That is pure margin that that impacted. And that will continue to have an impact as people continue to renew their contracts. But storage mix as a percent of revenue has remained pretty much consistent at 11% of our revenue as associated with storage. That did not change.”

On storage migration headwinds due to Iceberg: If customers move some of their data from Snowflake to Iceberg and that creates a revenue headwind, how can this be a good thing, you might ask? That’s also what Brent Bracelin from Piper wondered:

Analyst: Sridhar, in your opening remarks, you flagged Iceberg as the potential unlock that could accelerate growth. Maybe that’s a longer-term view. But can you just walk through how or why spending could actually go up for Snowflake in an environment where customer moves to Iceberg? Thanks.

CEO: So, first of all, Iceberg is a capability. And it is a capability to be able to read and to write file in a structured interoperable format. And, yes, there will be some customers that will move a portion of their data from Snowflake into an Iceberg format because they have an application that they want to run on top of the data. But the fact of the matter is that data lakes or cloud storage in general for most customers has data that is often 100 or 200 times the amount of data that is sitting inside Snowflake . And now, with Iceberg as a format under our support for it, all of a sudden, you can run workloads with Snowflake directly on top of this data . And we don’t have to wait for, you know, some future time in order to be able to pitch and win these use cases, whether it’s data engineering or whether it is AI, Iceberg becomes a seamless, you know, pipe into all of this information that existing customers already have, and that’s the unlock that I’m talking about. I’ll also have Christian, you know, say a word. He’s been at this for a very long time and has a lot of insight on.

Executive Vice President, Product: Echoing what Sridhar just described, they have lots of data, tens of petabytes of data ready to be analyzed. They don’t think that it makes sense for – that they have to be copied or ingested into Snowflake, but they have use cases where they want to combine data in Snowflake with that existing data. So, the opportunity is very real. And what Sridhar also alluded to, the announcement we made with Microsoft in the last two days is entirely about that. How do we take the data that is available in Microsoft Fabric and, through Iceberg, make it available to Snowflake. So, the opportunity is not a long-term one. It’s not framed that’s something that we’ll have to wait a lot for.

On the data sharing side, Snowflake performed very well this quarter: Market place listings grew 6.2% QoQ, up from 3.6% in Q4 and >1 stable edge customers grew 23% QoQ, up from 2.6% QoQ in Q4 adding a record new 590 customers to this cohort (up from 65 in Q4). I think the strong performance we got this quarter will continue feeding their flywheel. For example: “ Through a strategic collaboration with Fiserv, Snowflake was chosen by more than 20 Fiserv financial institutions and merchant clients to enable secure direct access to their financial data and insights.” And more generally: “Obviously, the big unlock there is that any business user now has access to data within Snowflake. Authorized and governed, of course, but it’s a much larger user base that can directly interact with Snowflake. And that’s the complement, you know, where there is a direct access to data to a much larger user base.”

Finally, let’s talk about profitability. While FCF margin was as strong as I had expected; 44%(!), both 4% operating and 6% net margin took a hit this quarter and are expected to be impacted together with FCF for the rest of the FY. The reason for the lower operating and net margins was a significant increase in R&D spend, which grew 57.5% YoY. The reason they gave for this and the down-revised operating income and FCF margin guides was “in light of increased GPU-related costs related to our AI initiatives. We are operating in a rapidly evolving market, and we view these investments as key to unlocking additional revenue opportunities in the future. As a reminder, we have GPU related costs in both cost of revenue and R&D.” Although I’d like their margin expansion to continue eventually, I think it makes sense for Snowflake to grab as much as they can from the AI opportunity that lays in front of them. We have just seen that the hyperscalers and other big players like Meta are doing just the same - by significantly increasing their spend on GPUs this year. In addition Snowflake also hired a sizable amount of employees from TruEra which will give them valuable AI observability functionality. So depending on how big we think the revenue opportunity in front of them is, we should be careful in valuing this relative drop in profitability. IMHO, given the coming AI wave and how early Snowflake is we should probably focus more on revenue growth than profitability margin expansion - at least for the next couple of quarters. I also think we shouldn’t be too afraid that Snowflake’s investments into AI will balloon going forward. At least the CEO’s commentary around that sounded reassuring “our AI budgets are modest in the scheme of things” [$50M for GPUs]. And after the earnings call, on Cramer’s Mad Money, the CEO hinted at extra GPU investments being more temporary and moderate: “Margins are really really important. We are leaning ahead into investing with AI. These are modest size investments, and I don’t expect these numbers to dramatically go up.”

A quick word on stock-based-compensation (SBC) and dilution: I keep seeing people pointing towards what they call “crazy high dilution”, referencing it to be 40% of revenue. Because SBC doesn’t cost the company a single cent, I instead prefer to look at dilution of shares outstanding, which have been up by only 2.8% YoY (331,079 in 1Q25 vs 321,924 in 1Q24). Now, before re-starting the age-old SBC / GAAP vs. non-GAAP discussion, please first read some of the many discussions we had on this board about this topic, for example here (and you can find many more threads like this using the search bar):

So looking at all of this, I think Snowflake is set up for revenue growth durability at around 30% YoY, with the potential of revenue growth acceleration with all the new AI products that become generally available this year. For now, I’ll just wait and see if this vision pans out or not. I also wanted to give a shout-out to Brian Stoffel (@TMFCheesehead), who I thought nicely summarized Snowflake’s quarter, here: https://www.youtube.com/watch?v=xZ1MjZD-0Nw. He also talks about valuation (which I normally don’t), which might be interesting to some as this has been historically one of the highest valued stocks in tech. I’d just add two cautionary words to this by quoting first Saul, (bolding mine)

as well as Brian himself, putting the valuation discussion into perspective:

Wrap up

It has been an exciting earnings season so far! Overall, I am happy with how our companies performed. So just take the following as a word of encouragement if you feel fear, uncertainty and doubt in this current investing environment: I think the negative stock price reaction after some of these reports had more to do with the overall market sentiment resulting from the fact that the FED’s rate cuts will come much later than everyone thought at the beginning of the year, combined with AI revenues likely showing up slower than people expected. I could be wrong, (and don’t want to get into a lengthy and off-topic macro discussion) but I think the former is weighing heavily on companies stock prices who’s majority of cashflows are expected far in the future. But I think this sentiment can easily change in a couple of quarters and when it does, strong business results will again be valued more by investors. Meanwhile, I am looking forward to the earnings results from Crowdstrike and Samsara which are coming up shortly!

Last, but not least, Zscaler just reported and while I didn’t have time yet to fully digest this report, here is a quick comparison to my prior expectations:

- Reported Fiscal Q3 2024 on 05/30/24.

- Revenue expectation: $560M (6.6% QoQ, 33.7% YoY), expectation from billings model and 4.6% beat.

—> They got $553M (5.4% QoQ, 32.1% YoY).

- Q4 new revenue guide: $568M (1.5% QoQ, 25% YoY) which I would interpret as $591M (5.5% QoQ, 30% YoY) as my expectation from billings model, assuming Q3 QoQ billings growth of -3% (seasonal!).

—> They guided for $566M (2.3% QoQ, 24.4% YoY).

- I would like to see Q3 billings of around $609M.

—> Billings came in at $628M (+0.1% QoQ, 30.2% YoY). Keep in mind, this is a very seasonal metric! This was the first positive sequential billings growth since my recording of this metric in 2017. Also impressive because their original billings guide for Q3, which they gave in the Q2 conference call implied the strongest sequential Q3 drop in the last five years: a 7% decline in billings (while in the last four years, they typically only declined 2-3% sequentially in Q3, with an exception of 2022, which was a 6% decline). So this billings result was significantly better than I had hoped for. And another reminder: for Zscaler in particular, we care about billings because in the past it has been an excellent predictor of next quarter’s revenue growth (haven’t had time yet to update my model).

- I would like to see RPO grow more than 7% QoQ.

—> RPO grew 5.8% QoQ.

- I would like to see >100k ARR customer growth around 4% QoQ.

—> >100k ARR customers grew 3.6% QoQ.

- I would like to see >1M ARR customer growth around 6% QoQ.

—> >1M ARR customers grew 5.2% QoQ.

- I would like to see an operating income around $118M.

—> Operating income was $122M, resulting in a healthy profitability margin expansion over last Q3, expanding OM from 15% to 22%, NM from 18% to 25% and FCF margin from 18% to 22%.

- Detailed Q3 pre-earnings thoughts: Ben’s Portfolio update end of March 2024

And with that, I thank you for reading and wish you all a great June!

Ben

Past recaps

July 2022: Ben’s Portfolio end of July 2022 - Saul’s Investing Discussions - Motley Fool Community

August 2022: Ben’s Portfolio end of August 2022 - Saul’s Investing Discussions - Motley Fool Community

September 2022: Ben’s Portfolio update end of September 2022

October 2022: Ben’s Portfolio update end of October 2022

November 2022: Ben’s Portfolio update end of November 2022

December 2022: Ben’s Portfolio update end of December 2022

January 2023: Ben’s Portfolio update end of January 2023

February 2023: Ben’s Portfolio update end of February 2023

March 2023: Ben’s Portfolio update end of March 2023

April 2023: Ben’s Portfolio update end of April 2023

May 2023: Ben’s Portfolio update end of May 2023

June 2023: Ben’s Portfolio update end of June 2023

July 2023: Ben’s Portfolio update end of July 2023

August 2023: Ben’s Portfolio update end of August 2023

September 2023: Ben’s Portfolio update end of September 2023

October 2023: Ben’s Portfolio update end of October 2023

November 2023: Ben’s Portfolio update end of November 2023

December 2023: Ben’s Portfolio update end of December 2023

January 2024: Ben’s Portfolio update end of January 2024

February 2024: Ben’s Portfolio update end of February 2024

March 2024: Ben’s Portfolio update end of March 2024

April 2024: Ben’s Portfolio update end of April 2024